Disclaimer: Originally published in September 2017. It is being republished since it still remains an interesting topic till today.

As per the definition of Wikipedia,

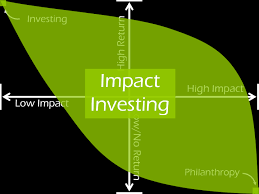

Impact investing refers to investments “made into companies, organisations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside (or in lieu of) a financial return.

They basically generate both financial returns and social or environmental good and hence has been taken up by a lot of well-known financiers and companies.

It is of utmost importance that each and everyone from venture capitalists, investment banks to foundations and individuals are part of impact investing to make it truly a success.

This practice is further established by the following core characteristics of intentionality, investment with return expectations and range of return expectations and asset classes.

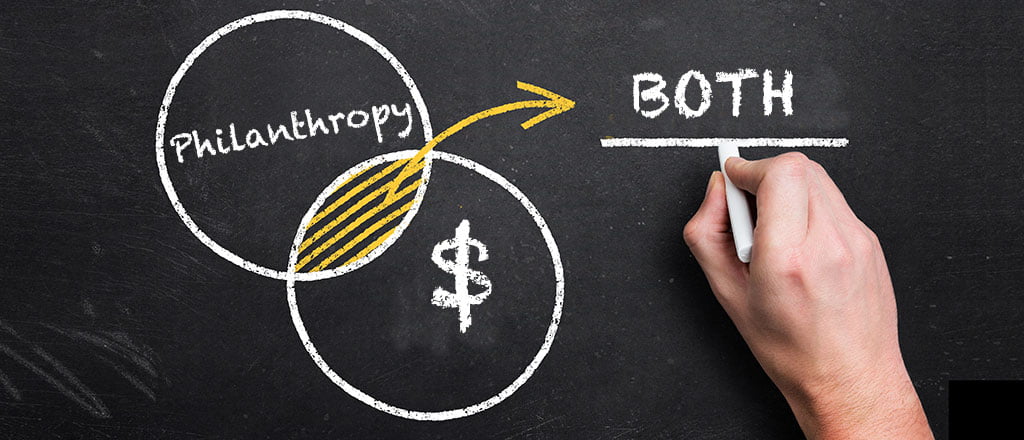

Impact investing challenges the age-old view that social issues should be solved or looked after only by philanthropic donations, and that market players should focus on achieving financial returns only. Impact investments is a combination of the same and aims to take in the best of both the worlds.

How do impact investments perform financially?

Impact investors have a wide variety of financial return expectations. Some of the investors actually invest for less than market-rate returns, in line with their strategic objectives, while others pursue market-competitive returns which is sometimes required by fiduciary responsibility.

As per the investors surveyed by the GIIN in 2016, most of them pursue competitive, market-rate returns.

But then at the same time, GIIN also reports that portfolio performance overwhelmingly meets or exceeds investor expectations for both social and environmental impact and financial return, in investments which ultimately fulfills the motive.

Also read: Some Easy And Legal Ways To Evade Taxes

Live Examples Of Impact Investing In The Social Circle

It is heartening to see that impact investing has drastically improved the lives of women in Bolivia, the people and environment of Mongolia, and bilingual communities in the United States which further is a proof of the fantastic potential of the new phenomenon.

The Enactus model followed all over the world in copious colleges somewhat follows a similar concept where they can get grants or investments from a particular company which can further be used for positive social impacts and eliminating the evils.

LeapFrog Investments invests in AllLife which has established projects to both bring about a positive change as well as draw profits out of the same.

How Widespread is Impact Investing?

Impact investing is relatively among the masses which is used to describe investments made across many asset classes, sectors, and regions. As a result, the market size has not yet been fully discovered and exhausted. The scope of potential is huge.

Impact Investing is still in the nascent stage in India and if implemented with the right motive, it can achieve great heights.

Image Credits: Google Images

Read More:

Here Are Some Smart Investment Moves To Secure You Financially