“A fool and his money are parted; rest of us wait till it’s time for taxes”

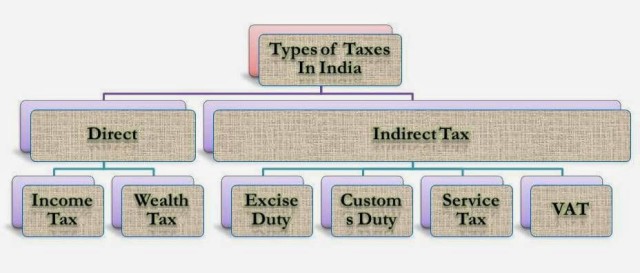

A tax, as defined by most Economics Textbooks is a “financial charge or other levy imposed upon a taxpayer (an individual or legal entity) by a state or the functional equivalent of a state such that failure to pay, or evasion of or resistance to collection, is punishable by law.” Money thus collected is used by the state for expenditures on various matters worth governmental interest.

Hence, for the taxpayers, taxes are pretty disappointing. Having said that, do you know of anything far more disappointing than tax-payments?

Kamaal R Khan?

Nah! You’re not even close!

In fact, mistakes in filing your tax returns have the potential to disappoint you beyond imagination.

Here are seven common misconceptions you mustn’t be involving in:

1. The TDS Conundrum:

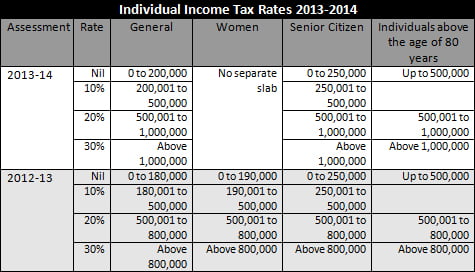

Comprehending the concept of Tax Deductible at Source has become a spot for confusion since time immemorial. Majority of the blunder takes place with bank interests. Banks deduct tax if the interest earned exceeds Rs.10,000 per annum. However, if interest doesn’t exceed 10,000 and tax isn’t deducted by the banks, one has to add this amount to total income to calculate tax amounts applicable.

Failure to report this tantamounts to concealment of income and tax authorities shall do the rest!

2. Lack of Expenditure:

Not spending at all and directing your income completely towards investment could make it a tiring process as well. The officials could question you over investing too much and/or withdrawing too little. If your estimated expenses can not be matched to your withdrawals, you’ll be questioned as to where-from the necessities are being met.

3. Getting away from paying Wealth tax returns:

Income Tax isn’t the only tax to face. If one has properties such as gold, silver, vacant houses, non-agricultural houses, Wealth Taxes as applicable, are to be paid. The details pertaining to the filing of Wealth Tax must be abided by.

Getting away could cost you a fine 500% of the evaded amount and also a prison-term upto 7 years!

4. Gifts and related transfer payments:

How generous and loving could you get? Perhaps, far too loving that you could possibly gift a diamond worth Rs. 50,001? Well, that could possibly mean a huge amount spent in tax payment for the receiver of the gift! This being said, Gifts from unrelated people are taxable if the annual value exceeds Rs 50,000. The gifts received from blood relatives or on specific occasions like marriage or under inheritance or by will are not taxable.

5. Aggregating Income:

Yet another relevant issue is the discounting of income earned by minors and/or non-bread-runners of the family. As such, any and all incomes from investments made in the name of children are to be taxed as well.

However, in rare cases of when a spouse is employed by the individual and remuneration is paid, the remuneration will not be clubbed as the income of the individual. In all other cases, relevant rates apply.

6. Reversals of benefits:

The amount on which income tax is calculated in cases of employment salaries remains exclusive of provident fund contributions. Therefore, in cases where amounts are withdrawn from PF while quitting a job, one must pay back income tax as applicable. The same applies to benefits received under matters such as insurance policies and sale of properties like houses.

7. Not filing a return at all!:

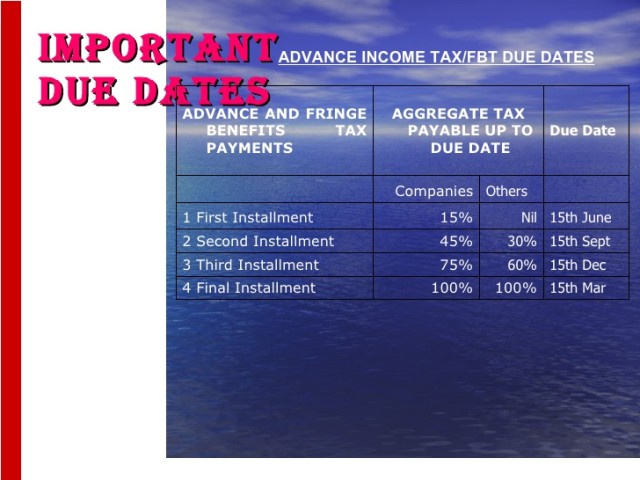

This is another common mistake. Most people, keeping the notion that Tax is Deducted at Source (TDS) from salaries, do not file returns at all. This would only attract a notice from the authorities after the deadline for a filing. No matter what, if your income exceeds Rs. 2 lakhs, one must file a return. This applies even if the tax liability is reduced to zero after taking the benefits into consideration.

Nevertheless when simply put, compliance with tax law is the key. This isn’t the key for you and me alone, but also for our nation as a whole. As citizens, it is important for all of us to pay our tax regularly. We must not groan for the burden of the tax, instead should think about the utilities that we receive from the tax. It can be simply said that we are paying rent to live in a wonderful country. Also, had you missed on any part of your income, I suggest you file a revised return. This not only makes you a responsible citizen, but also ensures you sound sleep!

Picture credits- Google images

By S. Shahid Abdul Majeed