FlippED: An ED Original style wherein two bloggers come together to share their opposing or orthogonal perspectives on an interesting subject.

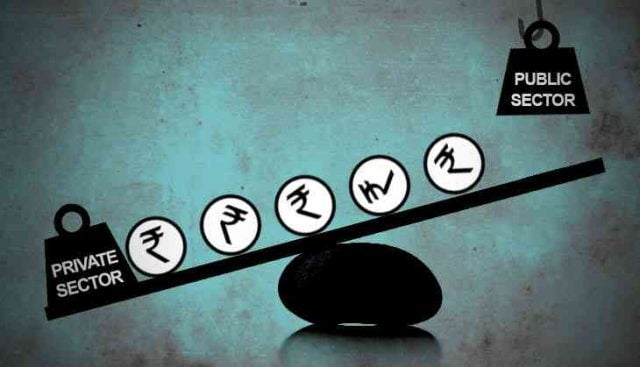

Privatisation of public sector banks in India seems to have become the new mantra to solve all our banking hurdles. But will doing so genuinely help the banking sector or is it just an expensive farce which will do no good?

Public Sector banks in India are in a bad share and there isn’t an iota of doubt that the problem runs deep and needs to be fixed. Is privatisation the answer or will consistent reforms by the government heal it?

Let’s find out the diverse viewpoints regarding the same.

Privatisation Of Public Sector Banks Is The Need Of The Hour– Manas

Yes, there are numerous risks involved in privatizing banks in India. As a student from Commerce background, I have always been taught about the risk-return trade-off.

I’ll break the concept down for a layman. Higher risk is usually associated with greater probability of higher return and lower risk with a probability of smaller return. Thus, the trade-off that one faces between risk and return is called risk-return trade-off.

Now, as I mentioned, privatization of banks would be a risky business, no doubt. But the possibilities of higher return outweigh the risk involved, at least for me.

For how long can we turn a blind eye to the upsides only to avoid the downsides of privatization?

Ownership

Public-sector ownership of the banks has handicapped the system for years.

The ownership is so widespread that the control goes out-of-hand. The effective control desired by the shareholders is lost, unlike a private ownership where everything happens right under the nose of the shareholders.

Competitiveness

The competitive edge that drives towards innovation doesn’t exist and so the banking system becomes inefficient. Since the government has a monopoly in the banking sector, people suffer as the quality of services goes down.

With privatization, there will be efficient management and control of the banking sector which will fall in line with the growth objectives of India.

It is important to maintain the fiscal discipline that has earned India huge amounts of foreign investment over the years. With lack of control, the banking system will lose its discipline as well.

The Indian economy is growing at an astonishing rate, which has never been observed before. Public-sector banks, however, haven’t been able to keep up with the growth. As a result of the inefficacy of the public-sector banks, the economy is being held back.

For years, the GDP growth rate in India has been looming around the 7 percent mark. This could be our shot at reaching the ambitious 10 percent mark.

Frequent Recapitalization

Another problem that the government has faced in the public ownership of the banking sector is the frequent recapitalization (Infusion of capital in the banks to save it from sinking) of banks, which puts unnecessary pressure on the Government budget.

The hard-earned money of the taxpayers can be put to better use if the government can free itself from the trouble of recapitalization.

There is no indication of public-banks to be free from any sort of crisis, as evident by the recent suffering of the Punjab National Bank (PNB) and the State Bank of India (SBI).

Privatization of banks has been done before and it was widely regarded as a successful step.

It’s the right time for the government to let go of the banking sector and give the economy what it deserves.

Also read: Who Are The Gupta Brothers And How Did They Bring About The Crisis In South Africa?

Privatisation of Public Sector Banks will be expensive, risky, unnecessary and will do the banking sector no good– Sriraj

Muhammad Yunus, the Bangladesh-based champion of micro-finance who is not in favor of privatisation of public sector banks (PSBs) said in an interview-

“Fraud in anything is bad, frauds in banks is a more sensitive thing, so we have to find a way to stop it. We have private sector banks in many other countries. Their performance is not something exceptional.”

Reform Is The Need Of the Hour And Not Privatisation

As pointed out by RBI in the recent PNB scam, it failed the three lines of defense – officer sanctioning the loan, at the managerial level and internal audit. There is absolutely no guarantee that these loopholes can suddenly be solved due to privatisation as seen in the case of the collapse of Lehman Brothers in 2008.

Many private banks have regularly been a victim of mismanagement. Accountability and reform is indeed the need of the hour and is of utmost need but privatisation of PSB’s only to fix these problems is no sane argument.

Exaggeration Of The Problem At Hand

Though there is no denying the fact that bailout costs to save a sinking bank are quite high but when we compare the costs compared to other developed and developing countries, we stand in a good position.

As stated in Economic Times, the current recapitalization plan, which would amount to Rs 2.11 lakh crore over two years, would account for less than 0.5% of current year GDP, and less than 0.25% annualized for two years.

By no means does it mean that we keep on increasing our bailout costs, but taking a hasty decision to privatise public sector banks will be a step in the wrong direction.

Merging Of PSBs

One needs to keep in mind that the government is planning to merger some public sector banks so as to make them stronger and distribute the losses among them. This might be a prudent step rather than going on to privatise the banks.

Objective

Most importantly, one must not forget that PSB’s have inherently a social objective to cater to the weakest in the country.

As mentioned in Livemint, though it is required for state and private sector banks to lend 40% of their loanable funds, at a concessional rate, to the priority sector, the major responsibility and burden fall on the shoulder of the state-run banks as they are the major players in the banking industry.

Thus, the above factors and other copious points strongly resonate with my point that privatization is expensive, risky and unnecessary and will do the banking sector no good.

Sources- Economic Times, Livemint, Hindustan Times

Images- Google

Other Recommendations-

http://edtimes.in/2018/05/quoraed-what-is-the-one-thing-that-you-have-learnt-which-most-of-the-upsc-aspirants-are-missing-out-during-their-preparation/

http://edtimes.in/2018/04/how-strong-is-the-indian-passport-in-reality-and-not-according-to-pm-modi/

95% of the NPA and Bank Frauds in North India upto the borders of the Vindhyas are on account of Bania vermin ! No one talks of the said statistic as every media house is owned and managed by banias or has 75% of the advert revenue from Banias

The entire banking system is designed as a wealth transfer system to move funds from Indian clowns in SB accounts and Fancy Bonds – which funds Banias ,who steal the money for Netas ,and then avail of CDR/OTS

Which is Y I support the 26/11 attacks on Hindoosthan ! They were designed to kill the Bania filth (Marwari-Gujarati-Kayastha scum) at one shot.

Kasab and his ilk lost the plot – as they started the rape orgies. They lost focus.

It is the Bania filth who worked as spies for each invader into Hindoosthan ! They also funded the wars of the Mughals and Sakas and Huns. There is not one 1 record in history of them having stood up for anything !

The Birlas,Goenkas,Bajajs and other bania filth built their empire by sending their women to Nehru for his peccadilos.They also funded Ambedkar in London – result that – Ambedkar spoke not one word against the Bania vermin !

The Bania loot the banking system as a matter of right using netas and suck the blood of the poor by the route of arhatiyas and traders in the agri supply chain and then on on all food & consumer goods value chains as price gougers,hoarders, contaminators, counterfeiters etc.Since these vermin manipulate the supply and value chain of agri items – these vermin are now the owners of COMEX in agri items to control the whole value chain of manipulation,cheating and fraud.

The vermin have no skills in any domain – except that of cheating and exploitation.The reason for the growth of the cluster mafia approach of the bania vermin, is that – they trade among themselves on clean credit basis and in cash.As time passes the cluster will naturally expand.This destroys the enterprise of all other races.If you analyse the bank managers and directors who sanctioned the loans of fraud, willful defaulters and NPAs -they are all banias,marwaris,gujaratis,kayasthas and brahmins

What is a Gujarati – who are also called Bastards in the Mahabharata ! dindooohindoo

The Mahabharata , Book 8: Karna Parva ,Section 45

The Pancalas observe the duties enjoined in the Vedas; the Kauravas observe truth; the Matsyas and the Surasenas perform sacrifices, the Easterners follow the practices of the Shudras; the Southerners are fallen; the Vahikas are thieves; the Saurashtras are bastards.

The Gujaratis are also termed as a race of Miscegnation – in the Mahabharata ! That word refers to those born of unnatural sex ! Gujaratis are a Bastard race ! They swap wives ! And they do it openly and ADVERTISE IT OPENLY !

https://gujarat.locanto.net/tag/couple-swapping/ http://gujarat.lookingmale.com/WIFE-SHARING/Couple-Swapping-in-gujarat.html

Similarly, The Rajasthanis are also sons of prostitutes as under :

Sample these Rajasthani sons of harlots born out of Nata Pratha – which is basically child prostitution for a fee !

http://timesofindia.indiatimes.com/city/jaipur/Kids-most-vulnerable-to-abuse-due-to-Nata-ratha/articleshow/56263686.cms

And these Gujaratis like I said are a breed born of harlots and have a system of organised prostitution by registration – called Maitri Karar – which is registered by the DM

http://www.patheos.com/blogs/drishtikone/2013/01/maitri-karar-gujarati-social-custom-of-keeping-mistresses-by-circumventing-hindu-marriage-act/

These vermin have to be exterminated en masse. It was Kasab and the Mujahideen who reckoned their evil.Their evil is also recorded in the ,Mahabharata as a bastard race

Kasab is a Che Clone ,with the look of Al Pacino ! May Allah rest his soul