By Tanmay Mehra and Sriraj Singhania

We are back with FlippED! And this time our two Bloggers are fighting about the much-debated issue of the GST. There are many arguments in support and in opposition. So let’s find out: Will the GST regime be a hit or a miss?

Tanmay’s take– It’s a six!

A brief intro before I start. The Goods and Service Tax (GST) was introduced in order to tackle the problems arising from the current tax system in place. All steps were taken to ensure a direction that would match up with this goal.

Now here are my ideas on why this tax system is more beneficial than the last.

Transparency

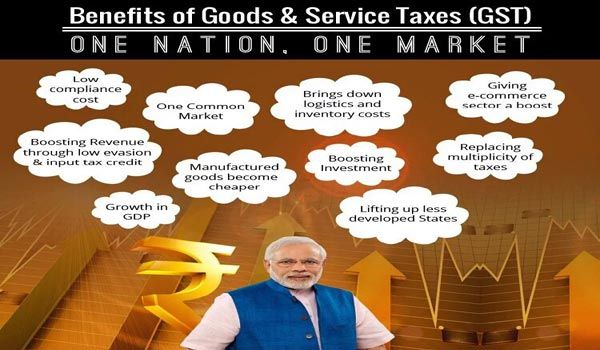

The GST system provides a uniform tax code which is transparent. There are no indirect taxes hidden in it. Unlike earlier times, where there was a cascading of taxes i.e. multiple taxes were added to create a net tax, that was a burden on the consumer. But now there is one single tax, nothing more and nothing less.

This transparency will not only lead to the removal of heavy taxation but will also directly combat corruption at the grassroots. I am not saying that it will completely eradicate it, but it will surely stem the tide.

Integration

Earlier, the taxes had to be divided by complicated formulas for that of goods and services. But now since there is a separate tax for both, the integration of the system into the mainstream becomes much easier.

Moreover, it will allow the taxes to be split equitably between manufacturers and service providers.

And speaking of integration, this system is accompanied by GSTN which is a fully integrated tax platform. Fully online and transparent.

Consumer friendly

The cost of business will be lowered as there are no hidden taxes and registered retailers won’t pay a dime extra. Also as GST will be levied at the final point and not the points in between, it will help bring out a common national market.

All in all, GST is a step in the forward direction. To rid us of the red tape of the previous regime and usher in a transparent, efficient regime.

Read More at FlippED- Our Bloggers Fight It Out Over: Does College Name Matter?FlippED- Our Bloggers Fight It Out Over: Does College Name Matter?

Sriraj’s Take– Clean Bowled!

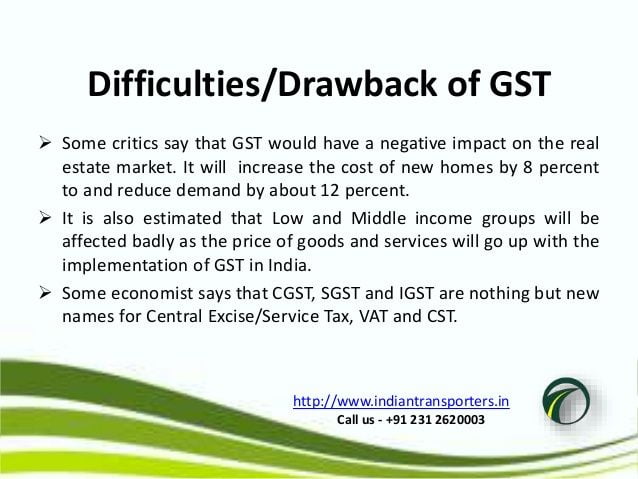

GST will have the same negative impact as “Demonetization” and as fancy as it seems to have a single tax structure, it will slow down the Indian economy and be an unsuccessful shot in the dark.

ANTI-PROFITEERING CLAUSE

One of the most important factors that everyone seems to miss is that the Centre and the States have agreed on an anti-profiteering clause in the GST.

The government has basically created a new authority which will decide whether businesses have reduced their prices enough when there is a reduction in the GST rate of the concerned good or service and, has the power of canceling registration if found guilty of profiteering and not passing on the tax benefit to consumers.

The pestering and the intimidation of the tax police to examine a company’s pricing structure to see whether a tax cut has been passed on or not is just absurd and time-consuming, to say the least. The whole concept of free market mechanism seems to go on a holiday and the pricing structure will be controlled by the tax watchmen resulting in tremendous workload for the corporates.

The current mechanism is too broad-based and difficult to implement. Is it possible to act against an eatery in Delhi that does not pass on the gains of the tax cut to consumers?

Such a clause is only useful when proper time is given to businesses to understand the nitty gritties of GST.

It has been hastily implemented in India.

Malaysia had implemented an anti-profiteering just ahead of its GST roll out and the move was a disastrous one which actually slowed down the whole business sector and it was finally been removed. We must take a leaf out of Malaysia’s GST book.

Killing the competitiveness of the Indian market

The Indian states compete with each other to attract private investment by offering lower taxes in comparison to others. That subtly explains why Gujarat got the Tata Nano deal ultimately because it commanded lower taxes in comparison to other states.

With a single tax structure all over India, it would kill competition and it would make no difference whether to establish a manufacturing unit in Bengal or Karnataka. Historically and logically, it is always in the interests of the consumer and a corporate if there is healthy competition.

The Death Of The Federal Structure

Everyone agrees to the simple fact that GST is fundamentally anti-federal which is the sole reason why states have been resisting it. They won’t be able to raise or lower taxes as they see fit economically or politically and will always need to go to the GST Council to bring about changes. The whole voting structure to bring about change in tax rate is flawed and heavily in favor of the Union Government. Also, once in, states will not be able to opt out of GST.

All in all, GST is poised to be the next big failure in the slew of disappointing steps taken by the government.

You would also like to read:

http://edtimes.in/2017/06/aadhaar-vs-no-aadhaar/