In the slang of ever so nervous economists, ‘Bubble’ can make any economist clammy in his hands. Bubble basically refers to a theory where the economic cycle undergoes a rapid expansion followed by an equally sudden contraction.

Investopedia also defines a financial bubble as, “A theory that security prices rise above their true value and will continue to do so until prices go into freefall and the bubble bursts.”

To understand, why economic analysts the world over are worrying about a potential bubble burst, scroll down my hearties ………

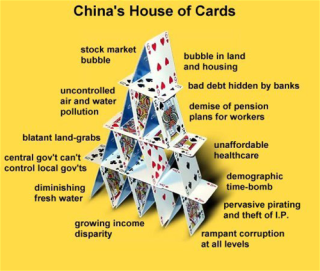

INDICATORS

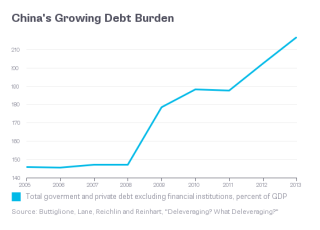

- High Debt

China’s total debt load equals 282% of total GDP or $18.3 trillion. It includes borrowing by government, banks, corporations and households. It accounts for more than a third of total world debt between 2007 -14.

Its common knowledge that China is building cities, highways and concrete jungles on an unprecedented spree. Much of these ridiculously extravagant projects are dubiously funded and approximately $540 billion forms bad debt. IMF has raised alarm regarding the vulnerabilities that the Chinese financial sector faces.

- Sliding Growth as GDP numbers fall

High debt levels don’t just raise the risk of a dramatic crash: They place a drag on growth as well.

China’s economy, once described as miraculous, is now struggling with rapid wage increases and a declining number of new workers, so productivity gains increasingly must come from structural reform, automation, greater company efficiency and innovation, as per a Wall Street Journal report.

The steel, concrete, glass, construction and home appliance markets, which count on home sales, are suffering as well. Government planners have ordered industries marked by excess production, such as steel, to cut back, but so far haven’t made much progress as local officials, fearful of increased unemployment, have found ways to keep factories from closing.

- Infrastructure Bubble & Overcapacity

A particularly strange and somewhat eery phenomenon has arose as a result of China’s building purely for the sake of creating economic growth – completely uninhabited “ghost cities,” highways, stadiums that are in the middle of nowhere. A notable fact includes that five of the ten world’s tallest skyscrapers are being built in China.

Why Dangerous?

- Economy of China is $8.2 trillion one.

- Today, simply put, a Chinese crash would make the 2008 collapse of Lehman Brothers seem like a mere market correction, if economy of China worth $8.2 trillion one comes down to its knees, it sure as hell won’t go alone.

- World hasn’t perfectly recovered from Sub-prime Crisis and Euro zone. The popping of China’s bubble will also pop bubbles that are derivatives of it, primarily the bubbles in commodities, emerging markets, Canada and Australia.

- China known as Main “Assembler” in Asia or more popularly “world’s factory,” two-thirds of its imports from East Asian countries into end products. China’s competitive advantage in low labour costs is already being eroded as the country with its one child per family policy is set to grow old; and its artificially low cost of capital and of borrowing will end if economic rebalancing is successful because of financial liberalization. [5]

Solutions: Probable Way Ahead for China

- What’s the answer? The most obvious is to allow growth to decelerate to the 4 percent to 5 percent range needed to wean China off excessive investment and debt.

- Barring such shock therapy, the government could develop, as McKinsey writes, “a broader range of tools to avoid excessive borrowing and efficiently restructure debt.”

- China should also employ more so-called macro prudential tools to deflate bubbles. The government could impose tight limits on loan-to-value ratios and ban risky mortgages like interest-only loans.

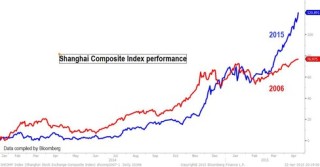

Solutions: Probable Way Ahead for You

Things are hot in China, I tell you. If you are a novice trader hoping to make a quick buck, and putting your technical analysis and stock market gyan to use, the Chinese stock market is your Mecca. You (at your own risk, mind it) can ride on the wave while it lasts. (Pun intended :D)

References

- Wall Street Journal

- The Guardian

- com/ChineseBubble

- com